India Fintech Market Share & Growth Analysis, 2032 | UnivDatos

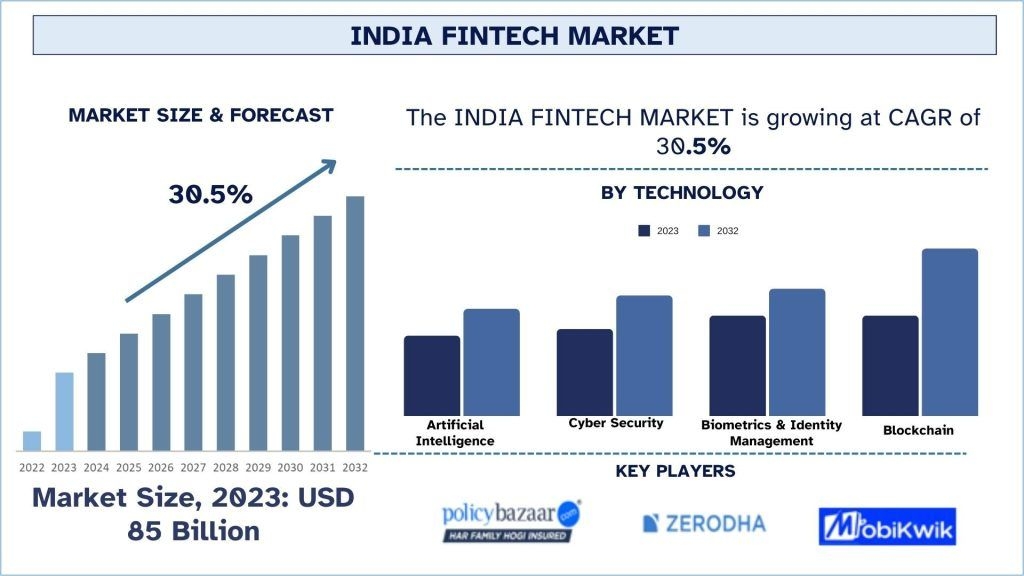

According to a new report by UnivDatos, the India Fintech Market is projected to reach USD billion by 2032, expanding at a robust CAGR of 30.5% during the forecast period. Fintech—short for financial technology—refers to the use of advanced digital technologies to deliver financial services more efficiently, securely, and accessibly. These services span digital payments, lending platforms, wealth management tools, insurance technology, and blockchain-based solutions, transforming how individuals and businesses interact with financial systems.

Fintech companies in India increasingly leverage artificial intelligence (AI), machine learning (ML), big data analytics, and blockchain to disrupt traditional banking models and meet evolving consumer expectations. This innovation-led ecosystem is reshaping the country’s financial landscape by improving service delivery, lowering transaction costs, and expanding financial inclusion.

Digital Payments Revolution in India

The rapid proliferation of smartphones and internet connectivity has catalyzed a digital payments revolution across India. One of the most significant milestones has been the introduction of the Unified Payments Interface (UPI) by the National Payments Corporation of India (NPCI). UPI enables seamless, real-time fund transfers between bank accounts using mobile devices, making digital transactions faster and more convenient.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-fintech-market?popup=report-enquiry

By 2023, UPI transactions had reached billions annually, reflecting widespread adoption across consumers, merchants, and businesses. This surge has significantly altered consumer payment behavior, encouraging cashless transactions and driving innovation across digital wallets, payment gateways, and embedded finance solutions.

The Indian government has played a critical role in supporting this transformation through initiatives such as Digital India and Startup India, which aim to promote digital infrastructure, entrepreneurship, and innovation. Additionally, regulatory bodies—particularly the Reserve Bank of India (RBI)—have introduced regulatory sandbox frameworks, allowing fintech startups to test new products in a controlled environment. This balanced regulatory approach fosters innovation while safeguarding consumer interests and financial stability.

Increasing Internet and Smartphone Penetration

Rising internet penetration and widespread smartphone adoption have been pivotal in accelerating fintech growth across India. Improved digital infrastructure has enabled millions of users, including those in rural and semi-urban regions, to access financial services without relying on traditional bank branches. This shift has significantly enhanced financial accessibility and inclusion.

Affordable smartphones and competitive mobile data plans have encouraged a mobile-first approach to financial services. As a result, mobile banking applications, digital wallets, and online investment platforms have seen rapid adoption. Fintech firms are designing solutions specifically optimized for smartphone users, emphasizing convenience, speed, and user-friendly interfaces.

The convergence of mobile technology and fintech innovation has also strengthened financial inclusion initiatives. Mobile-centric platforms offering microloans, digital savings, and SME financing are empowering underserved populations and small businesses by providing access to formal financial services previously out of reach.

Click here to view the Report Description & TOC: https://univdatos.com/reports/india-fintech-market

Regulatory Framework and Policy Landscape

India’s regulatory ecosystem plays a crucial role in shaping fintech growth and ensuring system stability:

- Reserve Bank of India (RBI): As the central bank, the RBI regulates banks, payment systems, and non-banking financial companies (NBFCs). It oversees fintech innovations in areas such as digital payments, online lending, and digital banking.

- Key initiatives include the Payment and Settlement Systems Act, 2007, UPI guidelines, and digital payment norms designed to ensure secure, efficient, and transparent transactions.

- Insurance Regulatory and Development Authority of India (IRDAI): IRDAI governs the insurance sector and supervises fintech developments in insurtech, digital insurance platforms, and online insurance distribution.

- Key initiatives include guidelines for digital insurance sales, insurance aggregators, and e-commerce platforms to promote transparency, consumer protection, and innovation.

Conclusion

The India fintech market is undergoing a transformative phase driven by rapid digitalization, supportive government initiatives, and technological innovation. Advanced technologies such as AI, ML, and blockchain are enhancing the efficiency, reach, and personalization of financial services. The widespread adoption of smartphones and internet connectivity has accelerated digital payments, with UPI emerging as a cornerstone of India’s cashless economy.

Regulatory institutions such as the RBI and IRDAI continue to play a vital role in balancing innovation with consumer protection and financial stability. Together, expanding digital infrastructure and a progressive regulatory environment underscore fintech’s growing impact on financial inclusion, economic growth, and the modernization of India’s financial ecosystem.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness